Is Now the Right Time to Purchase a Home? Analysing Cash Rates and Bank Interest Rates

06/10/2023

Diggers Rest: Set to be next boom suburb with new infrastructure

28/03/2024Exploring the Property Market Landscape of 2024

The latest insights from Domain's 2023 Year-End Summary and 2024 Forecast suggest a promising trajectory for real estate prices. Dr. Nicola Powell, Domain's Head of Research and Economics, observes a proactive response from buyers, sellers, and renters to the market shifts of 2023 and the potential developments in 2024.

Key Trends to Watch in 2024

1. Interest Rate Adjustments Boosting Demand: Lower than expected inflation may lead to interest rate cuts in 2024, potentially sparking a surge in demand and upward price trends.

2. The Pursuit of Affordability: Urban expansion and gentrification trends are expected as buyers seek affordable options. The ‘Help to Buy’ program by the federal government, a shared equity scheme, will play a crucial role in supporting demand for affordable homes, particularly units in larger capitals.

3. The Rise of YIMBYs Over NIMBYs: Progressive housing and planning reforms are forecasted for 2024, fostering a more welcoming attitude towards urban densification and innovative development approaches.

4. Population-Driven Housing Demand: Despite an anticipated normalisation of overseas migration by 2025, its impact on housing markets is expected to persist, contributing to a robust demand for housing.

The rental market's influence on the broader housing landscape is increasing, with a tipping point in rent growth and market balance anticipated due to stretched affordability.

Recapping 2023: A Year of Surprises

The year 2023 stood out as a period when property prices unexpectedly thrived despite escalating interest rates. The year was marked by a scarcity of new listings in the first half, followed by a surge in the latter half. Additionally, the end of ultra-low fixed loans and a generally pessimistic consumer sentiment did not deter the recovery of the housing market. The shortfall in housing supply, coupled with rapid population growth and a strained construction sector, contributed to this unusual trend.

2024 Outlook

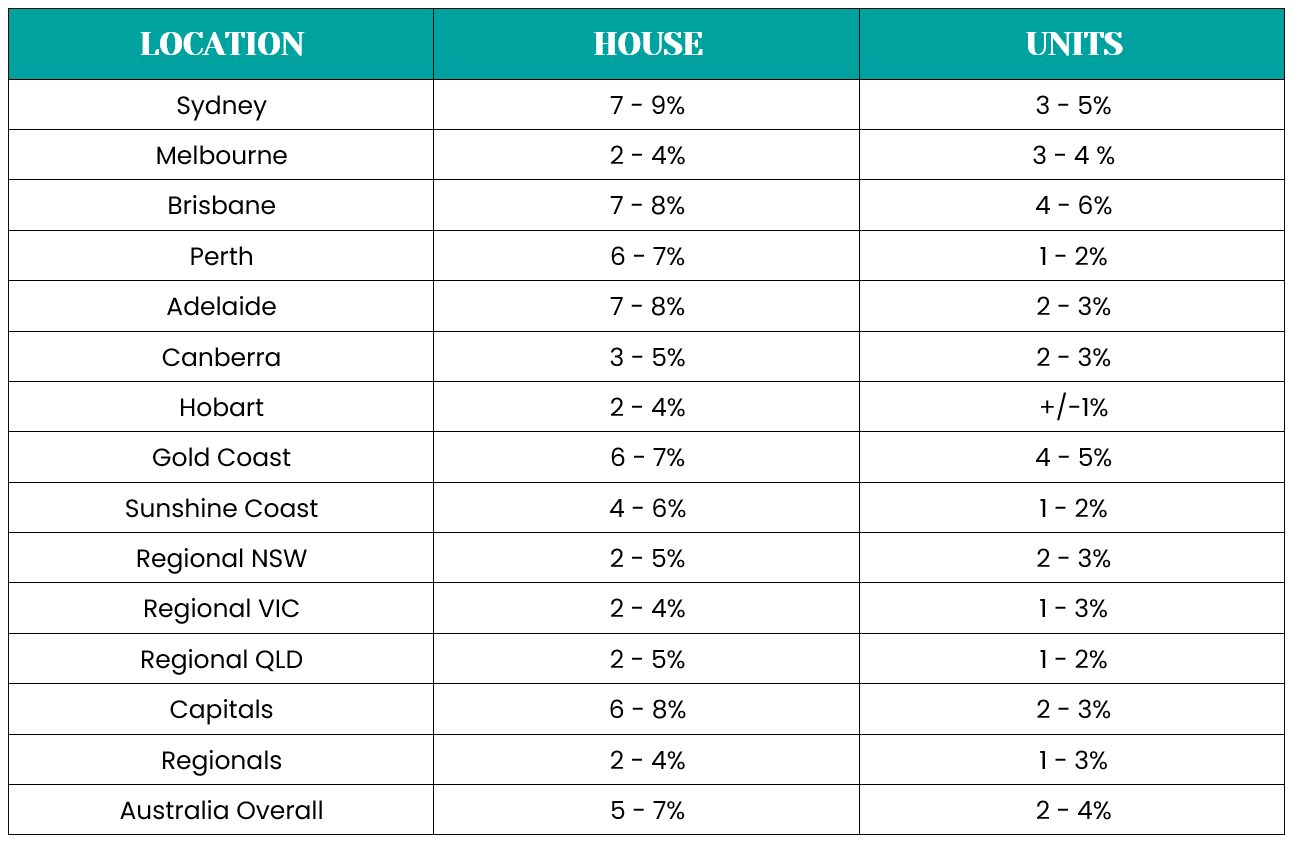

The property market in 2024 is set to be shaped by a mix of supply shortages, strong population growth, with potential interest rate drops. Record highs are forecasted for combined capital house and unit prices, with notable growth in cities like Sydney, Brisbane, Adelaide, and Perth. The year 2023 has indeed set a surprising precedent, and as we step into 2024, the market continues to evolve in unexpected ways.

Summary – What does it all mean?

It’s a lot of information to take on but there are compelling reasons for buyers to enter the Australian property market sooner rather than later, especially as we approach the end of the financial year. Here's a summary highlighting why acting now could be a strategic move:

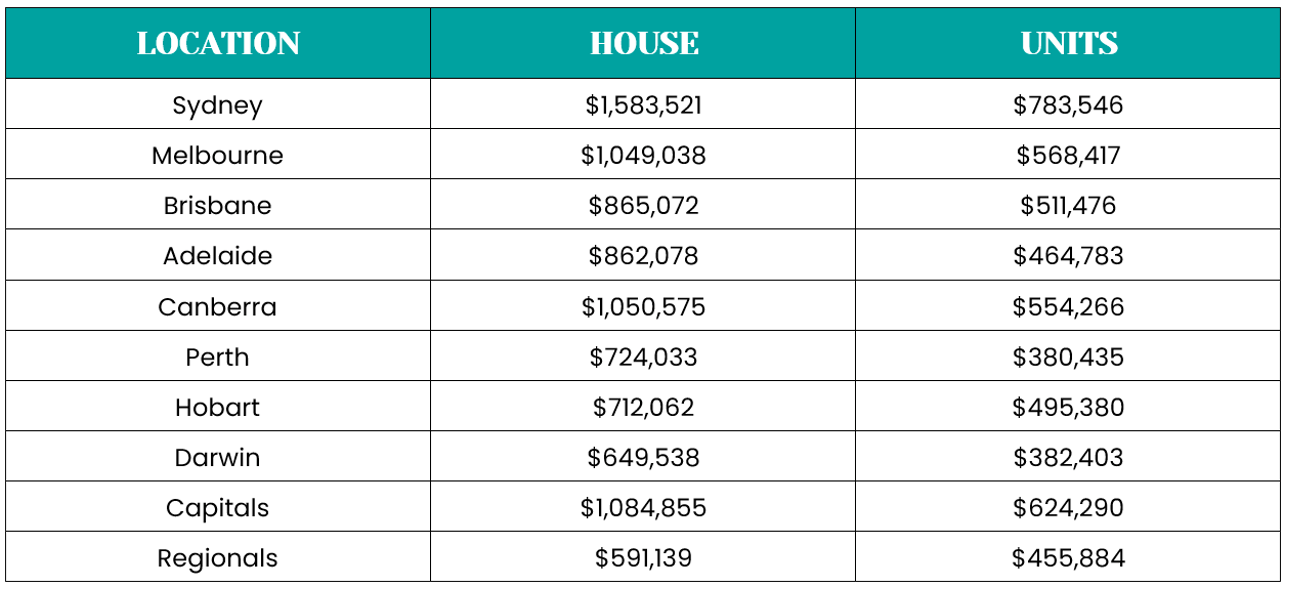

1. Rising Property Prices: The anticipated price trends for 2024 across various Australian locations indicate a consistent upward trajectory. With houses and units expected to see significant increases in value — ranging from moderate to substantial growth depending on the location — purchasing property now could mean capitalising on lower prices before the market experiences these projected rises.

2. Interest Rate Fluctuations: While current high-interest rates have been a concern, there's potential for interest rate adjustments that could boost demand. Entering the market before such changes take effect could be advantageous, as increased demand is likely to drive prices even higher.

3. Affordability Initiatives: Programs like the federal government's ‘Help to Buy’ scheme are designed to make property ownership more accessible. However, as these programs kick in, they could also stimulate increased competition and demand, pushing prices up. Buying before these initiatives fully take effect might enable buyers to avoid heightened competition.

4. Urban Expansion and Demand: The ongoing urban expansion and gentrification trends, combined with population-driven housing demand, suggest a continuously growing market. As demand increases, especially in urban and suburban areas, prices are likely to follow suit. Purchasing property in places like Davis Vineyard now could be a wise investment before prices escalate further.

5. Rental Market Dynamics: The shifting dynamics of the rental market, approaching a tipping point in rent growth and market balance, indicate that owning property might become more financially viable than renting in the long term. Investing in property now could secure a more stable financial future as rental markets continue to evolve.

In summary, given the forecasts of rising prices, potential interest rate changes, government incentives, and population-driven demand, purchasing property sooner could be a prudent decision. Acting now could allow buyers to secure property at more favourable prices and benefit from the anticipated growth in the market. As always, it's important for buyers to consider their individual circumstances and consult with financial advisors before making such significant investment decisions.